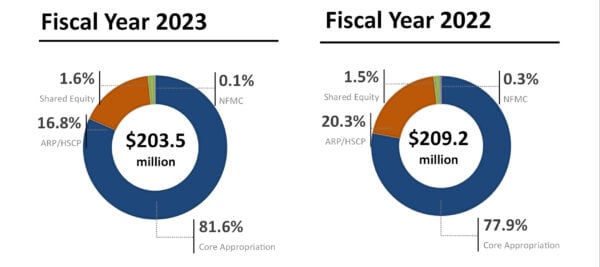

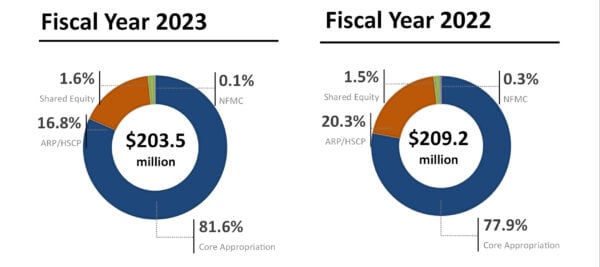

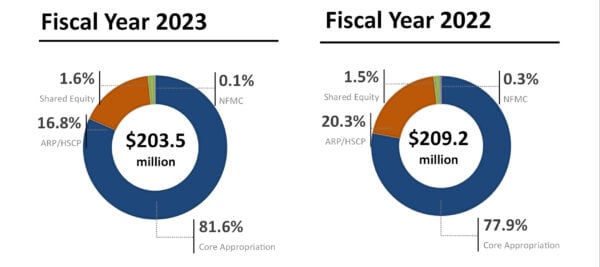

In fiscal year 2023, NeighborWorks America received a core appropriation of $166 million, a $3 million increase over FY22. In FY23, this funding provided flexible, strategic, training and capital grants to 247 NeighborWorks network organizations. The appropriation also funded two Virtual Training Institutes and two NeighborWorks Training Institutes, as well as other critical programming to promote the creation, preservation and investment in affordable housing and wealth building, organizational assessments to strengthen the capacity and sustainability of our network organizations, and general operations support.

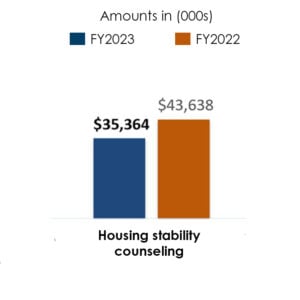

Congress passed the American Rescue Plan (ARP), which provided funding to NeighborWorks America to design and administer our Housing Stability Counseling Program (HSCP). This program aims to provide grants to support housing counseling for households facing housing instability, such as eviction, default, foreclosure, loss of income or homelessness. During FY23, NeighborWorks distributed $32 million in HSCP grants and $3.4 million in programmatic support. Additionally, NeighborWorks developed 35 HSCP-specific training courses to build counselor competency in serving renters and homeowners who were facing housing instability.

Shared equity housing models are a specific type of housing strategy designed to create permanently affordable homes, build wealth for families, and create vibrant, inclusive and equitable communities. Between fiscal years 2019-2023, Congress appropriated $12 million for a shared equity housing initiative to build the capacity of nonprofit organizations to ensure long-term affordability for their communities. Shared equity approaches included community land trusts, deed-restricted homes, limited-equity housing cooperatives and resident-owned manufactured housing communities. In FY23, NeighborWorks distributed $3.1 million in support of shared equity work.

Federal Appropriations

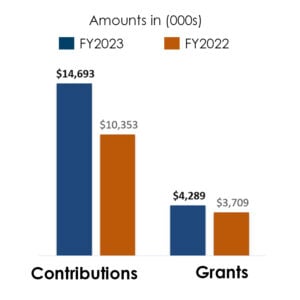

Grants and contributions are additional funds received from private corporations, foundations and federal agencies for specific programming and, at times, for general operational support. Contributions may come with restrictions or conditions that must be met before funds can be recognized. During FY23, NeighborWorks received $19 million in grants and contributions.

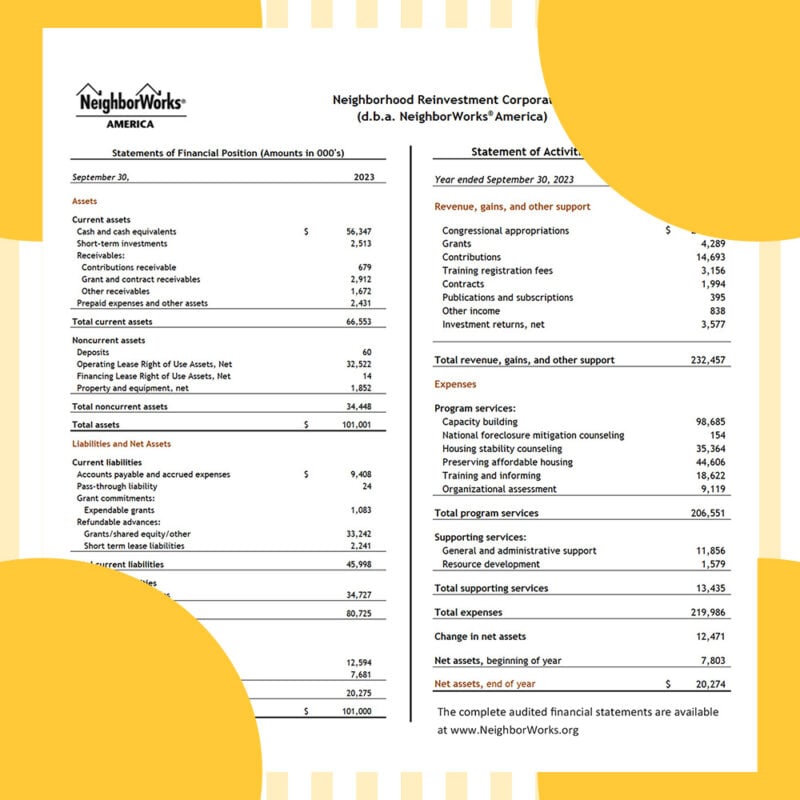

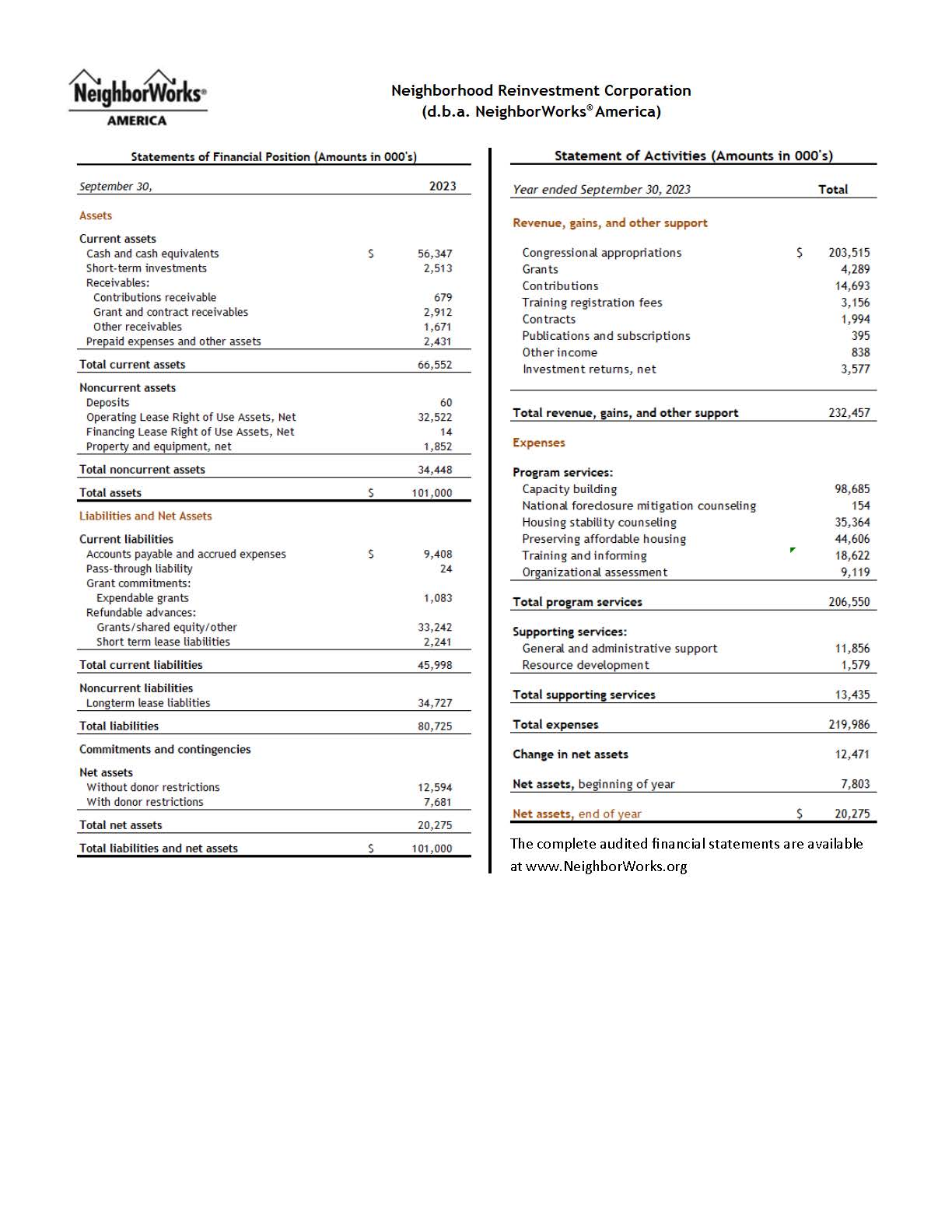

In FY 2023, NeighborWorks America had available $232.5 million with all funding sources combined. These funds, leveraged by our work and network organizations, were used to establish 16,270 new homeowners, manage 204,560 rental homes, repair 82,450 homes, and provide housing and counseling services to 428,000 families and individuals across the country while maintaining or creating 45,240 jobs in local communities. Our network leveraged the impact of our congressional appropriation 59:1. This work was accomplished by investing $206.6 million in program services, $11.9 million in general and administrative support, and $1.6 million on resource development activities. As for program services provided, the following describes each major program and investments made in FY23.

Other Fund

Sources

In FY 2023, NeighborWorks America had available $232.5 million with all funding sources combined. These funds, leveraged by our work and network organizations, were used to establish 16,270 new homeowners, manage 204,560 rental homes, repair 82,450 homes, and provide counseling services for 428,000 sessions for families and individuals across the country while maintaining or creating 45,240 jobs in local communities. Our network leveraged the impact of our congressional appropriation 59:1. This work was accomplished by investing $206.6 million in program services, $11.9 million in general and administrative support, and $1.6 million on resource development activities. As for program services provided, the following describes each major program and investments made in FY23.

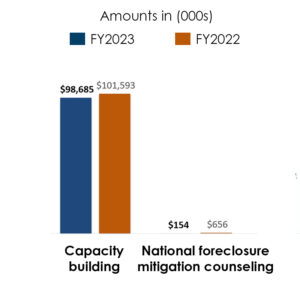

Capacity building is the practical assistance NeighborWorks America provides to strengthen the performance of its network organizations. The assistance is provided by way of grants and onsite technical assistance. NeighborWorks also promotes increased access to capital markets by supporting Community Housing Capital and NeighborWorks Capital. These corporations play a critical role in meeting the capital needs of NeighborWorks network organizations by providing low-cost, flexible, private-sector capital and innovative loan products to network members. These products help meet the financing needs for housing rehabilitation, and for homeownership and real estate development. During FY23, NeighborWorks invested $98.7 million in Capacity Building inclusive of $63.5 million in grants and $35.2 million in programmatic support.

The American Rescue Plan (ARP) provided funding to NeighborWorks America to design and administer our Housing Stability Counseling Program (HSCP). This program aims to provide grants to support housing counseling for households facing housing instability, such as eviction, default, foreclosure, loss of income or homelessness. During FY23, NeighborWorks funded $32 million HSCP grants and $3.4 million in programmatic support.

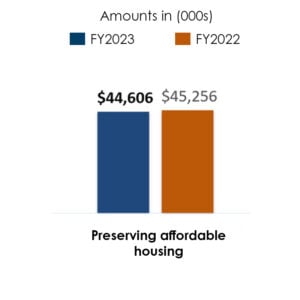

Preserving affordable homes is a key component of NeighborWorks’ mission. NeighborWorks helps our network organizations construct new homes, repair and renovate existing homes, promote homeownership and provide mixed-income affordable housing opportunities. Network organizations also provide hazard abatement, energy conservation, post-purchase counseling and foreclosure prevention services and programs. During FY23, NeighborWorks funded grants totaling $44.6 million in support of the creation and preservation of affordable housing.

NeighborWorks disseminates critical and emerging trends, data analysis and best practices through research, publications and training events that target both network organizations and the broader housing and community development field. During FY23, NeighborWorks held two large, in-person training institutes and continued offering a mix of in-person and vital opportunities for housing and community development professionals to learn from peers and faculty. NeighborWorks invested $18.6 million in training and peer–learning opportunities during FY23 to build the capacity of its network organizations and strengthen the broader industry, issuing 10,900 training certificates during the fiscal year.

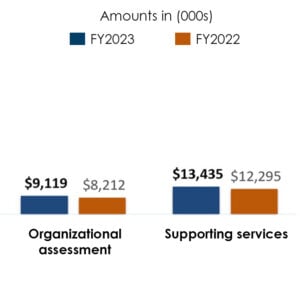

As part of our stewardship and to strengthen the sustainability of the network, NeighborWorks closely monitors the capacity and performance of each NeighborWorks network organization. The organizational assessments evaluate each network organization’s impact, financial sustainability, board governance and other critical health factors. Assessments recognize achievements in performance and identify and help mitigate and manage risk. In FY23, we invested $9.1 million in 151 assessments, 262 audit analyses, and 244 compliance assessments. Through these assessments, 72 network organizations took over 200 steps to improve their health by addressing areas for improvement and other critical health/risk concerns raised in the assessment process.

Uses of Funds

Partner

Investments

Partner investments make a difference

NeighborWorks America is built on partnerships – partnerships with our network, and partnerships with funders that understand who we are and what we’re trying to do.

This year, we shine a spotlight on partner JPMorgan Chase.

Partner Spotlight

For 20 years, JPMorgan Chase has invested in NeighborWorks America’s opportunities with a mission, always, to create a more equitable world. JPMorgan Chase’s leaders have invested in technology and in ways to close the racial wealth gap, supporting culturally specific training shared across the network. And they’ve invested in people, too.

That includes leaders, as shown by their support for NeighborWorks’ Advancing Leaders in Real Estate program. It includes residents who benefit from the long-term wealth-building strategies that JPMorgan Chase supports. And it includes affordable housing and community development staff members who can take advantage of training scholarships that allow them to build skills and resources for the communities they serve.

Those scholarships bring individuals to NeighborWorks’ premier training institutes. But they also allow NeighborWorks to provide place-based training, bringing the education straight to the communities themselves in places like Puerto Rico and Colorado and North Dakota. Last fiscal year, NeighborWorks was able to award scholarships to 1,244 individuals in all 50 states, D.C., and Puerto Rico.

“NeighborWorks’ partnership with Chase goes back at least 20 years,” says Jayna Bower, vice president, national partnerships. “They have invested in NeighborWorks to build the capacity and abilities of our network and of the industry. Together, we’ve reached thousands of practitioners over the years.”

One of those practitioners is Alma Guzman, who attended the NeighborWorks Training Institute in San Francisco in May 2023. “I was preparing to retake the HUD Counseling Exam,” she shares, “so the timing of this training could not have been better. The courses provided an in-depth look at the exam with scenarios and hands-on lessons involving Fair Housing. After completing the courses, I was able to get a better understanding of the exam content.” When she returned home, she registered for the exam – and passed. “I am very grateful because I would not have been able to attend the NeighborWorks Training Institute without the scholarship,” she says. “Passing the exam was critical for my position at Chicanos Por La Causa. In addition, it provided a strong foundation to increase my knowledge and role as a housing counselor.”

Michael Kelly, community building & engagement outreach coordinator at Trellis, received a scholarship to take a course on trauma-informed financial counseling, courtesy of JPMorgan Chase. The course gave him insights into clients who, on top of income-related stresses, had also experienced violence in the home and other types of traumas. “Almost all of us have experienced some form of trauma that affects our levels of trust,” he says. “How do we overcome that barrier to provide the services needed to enrich their lives to create homeowners and generational wealth and bridge gap?”

If Trellis wants to provide clients with financial services, first they must build and earn trust. “It helped us think differently,” Kelly said of the class. “Everybody needs to take this course.”

Michael Kelly

Scholarship Awardee

Thank you!

Thank you to the United States Congress and to our generous supporters.

American Express

First National Bank

Key Bank

Federal Home Loan Banks

Morgan Stanley

Citizens

Ocwen Financial

PNC

Pennsylvania Housing Finance Agency

These words add strength and unite the painted faces of teens that peer out at the people of Fitchburg, Massachusetts. They show connections, add a sense of belonging and include the element of partnership needed to make community art projects like this a reality.

These words add strength and unite the painted faces of teens that peer out at the people of Fitchburg, Massachusetts. They show connections, add a sense of belonging and include the element of partnership needed to make community art projects like this a reality.

The Kresge Foundation strengthened NeighborWorks’ understanding of this by supporting network organizations as they intwine arts and culture into affordable housing and community development – part of NeighborWorks’ journey toward comprehensive community development.

The Kresge Foundation strengthened NeighborWorks’ understanding of this by supporting network organizations as they intwine arts and culture into affordable housing and community development – part of NeighborWorks’ journey toward comprehensive community development.

After moving to Detroit, Michigan, Diana Franco and her family rented a home. “It was a nightmare,” she says. They moved to a new street, but still felt unsafe. When she discovered the Newberry neighborhood, she thought, “I wish we could rent here.” Homeownership was not on her mind.

After moving to Detroit, Michigan, Diana Franco and her family rented a home. “It was a nightmare,” she says. They moved to a new street, but still felt unsafe. When she discovered the Newberry neighborhood, she thought, “I wish we could rent here.” Homeownership was not on her mind. Still, she believes that the programs at the center of the cohort are making a difference. Three years of supporting and replicating equitable programs does not reverse racial inequities that have existed for hundreds of years, of course. “But we’re making inroads with the programs we have,” she says. “The goal was for the network to engage with each other and share replicable models and strategies. We did that. We also want to be a thought-leader nationally. We want to share these programs beyond the network; we want to share with the industry.”

Still, she believes that the programs at the center of the cohort are making a difference. Three years of supporting and replicating equitable programs does not reverse racial inequities that have existed for hundreds of years, of course. “But we’re making inroads with the programs we have,” she says. “The goal was for the network to engage with each other and share replicable models and strategies. We did that. We also want to be a thought-leader nationally. We want to share these programs beyond the network; we want to share with the industry.”

For 45 years, NeighborWorks, founded on a model of leadership, has known that good leaders help nonprofits soar. Through NeighborWorks America’s Advancing Leaders in Real Estate program, supported by funding from JPMorgan Chase, Ramakrishnan attended courses and built the relationships she needed as a real estate manager. It’s one of the many reasons why NeighborWorks created the program: To assist real estate professionals of color, like Ramakrishnan, in gaining technical skills to help with project management. What was even more beneficial: The program provided mentors to see them through. The relationships they built will last well beyond the initial year of the program.

For 45 years, NeighborWorks, founded on a model of leadership, has known that good leaders help nonprofits soar. Through NeighborWorks America’s Advancing Leaders in Real Estate program, supported by funding from JPMorgan Chase, Ramakrishnan attended courses and built the relationships she needed as a real estate manager. It’s one of the many reasons why NeighborWorks created the program: To assist real estate professionals of color, like Ramakrishnan, in gaining technical skills to help with project management. What was even more beneficial: The program provided mentors to see them through. The relationships they built will last well beyond the initial year of the program. “Raising the voices of Native professionals in housing and community development – that’s our goal,” shares Mel Willie, director of Native Partnerships and Strategy at NeighborWorks America. “We wanted leaders from Native-led organizations to get some additional leadership support. It’s a chance to have that executive-level training for housing and community development professionals from Indian Country.”

“Raising the voices of Native professionals in housing and community development – that’s our goal,” shares Mel Willie, director of Native Partnerships and Strategy at NeighborWorks America. “We wanted leaders from Native-led organizations to get some additional leadership support. It’s a chance to have that executive-level training for housing and community development professionals from Indian Country.”